Hill Republican defenders of clean energy tax incentives in the Democrats’ 2022 climate law will soon have to decide how far to push their demands.

Challenges and Controversies

For months, they have been firing off letters urging leaders to spare at least some of the credits to benefit solar energy, nuclear, hydrogen and other technologies. Speaker Mike Johnson promised to use a “scalpel” and not a “sledgehammer” to the suite of green subsidies included in the Inflation Reduction Act.

But in the tax portion of the GOP’s megabill, approved by the Ways and Means Committee earlier this week, the credits would in fact receive a bludgeoning, with a slew of climate tax credits now slated for phase-downs or full-out repeals that would disrupt clean energy projects across the country, including in red districts and states. And it’s exactly what many Republicans feared would happen.

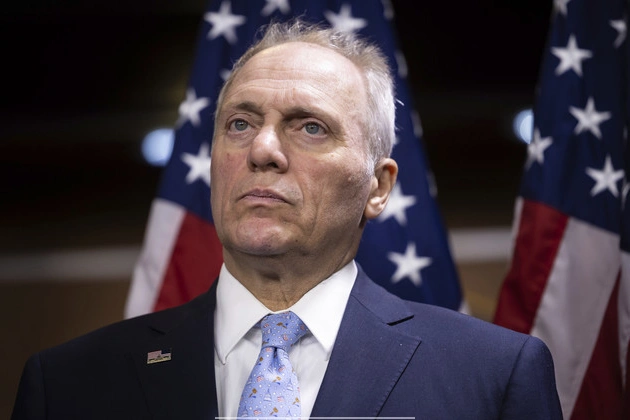

“I hate to say — it’s not as bad as I thought it was going to be, but it’s still pretty bad,” said Rep. Andrew Garbarino (R-N.Y.), who is the co-chair of the House Bipartisan Climate Solutions Caucus and has been at the forefront of advocating for the credits to be preserved amid the GOP’s takeover of Washington this year.

The Dilemma of Opposition

“I’m not happy with the way the bill is currently written,” Garbarino said Thursday. “We have alternative language and it’s something we’re going to work with leadership to try to get them to implement.”

The question now is whether Garbarino and his allies will threaten to oppose the tax, energy and national security spending legislation that carries much of President Donald Trump’s agenda unless leadership backs off its attacks on the credits.

Voting to tank the underlying megabill would put them at risk of enduring Trump’s ire — but letting their colleagues steamroll progress on major investments in their communities could make them crosswise with their constituents.

Strategic Conversations

It’s a potent dilemma for Republicans like Rep. Jen Kiggans of Virginia, who barely won reelection in her swing district last year. Kiggans said in an interview Thursday that she and other GOP lawmakers spoke with Johnson about the tax credits on the House floor and were preparing a formal document with their asks.

Those requests would follow a statement she and 13 other House Republicans released the day before that urged leadership for a narrow set of changes to the phaseouts and rollbacks approved by the House Ways and Means Committee.

Future Possibilities

But Kiggans, who noted projects in her state that have reaped rewards from the climate law tax incentives, said she wasn’t at the point of making threats.

“I’m not going to tell you it’s a red line because I don’t know what the end product is,” Kiggans added. “Across the country, there is a huge economic impact that would happen if we just cut these things off, and that that was kind of our concern.”

Rep. Buddy Carter (R-Ga.), whose district hosts a car and battery plant that benefits from Inflation Reduction Act tax credits, has been even more direct that he doesn’t plan to put up a fight.

Stance on Legislation

“For me, it’s not a red line,” Carter said back in March after joining one of the letters to leadership defending the incentives from Republicans who want to repeal the entire climate law. “For some people on that letter, it may be.”

Companies and trade associations are also blitzing congressional offices to make their case before it’s too late, including the Solar Energy Industries Association.

“I think a number of Republicans have significant insight into how our companies are working, and why certainty really matters for us,” said SEIA CEO Abigail Ross Hopper. “There’s absolutely people in that room that understand the problems we have with it.”

But they’re up against not only fiscal hawks unsympathetic to climate spending but pro-credit Republicans who have no problem with their leadership’s handling of the issue. That includes Rep. Blake Moore of Utah, the vice-chair of the House Republican Conference who sits on the Ways and Means Committee with jurisdiction over tax policy.

“I don’t know how we do anything different than what we just did,” said Moore. “I could be blindsided, but I think we found a nice sweet spot.”