Senate Democrats Allegations Against Bessent for Tax Dodges

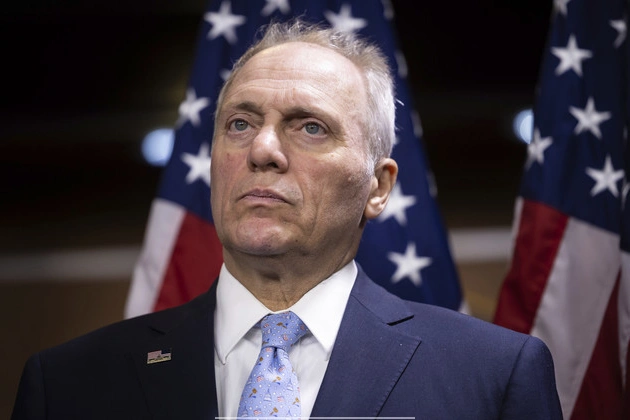

Senate Democrats are circulating serious allegations against President-elect Donald Trump’s nominee for Treasury secretary, Scott Bessent, regarding his tax practices. The memo prepared by Finance Committee staff under ranking member Ron Wyden (D-Ore.) claims that Bessent improperly claimed nearly $2 million in tax losses and owes almost $1 million in taxes related to his hedge fund. This revelation has provided fuel for Democrats as Bessent faces the Finance Committee on Thursday.

The Allegations

The memo alleges that Bessent should have paid $910,182 in taxes for income earned through his hedge fund, the Key Square Group, from 2021 to 2023. Bessent managed to avoid this tax liability by asserting that he was a “limited partner” not involved in decision-making for Key Square. However, Democratic staff on the Finance Committee argue that Bessent was actively engaged in fund decisions.

Questionable Losses

Furthermore, the memo highlights losses claimed by Bessent from income related to All Seasons Press, a conservative book publishing house. It questions the substantiation of $1,939,296 in losses, citing records that suggest Bessent was not actively involved in the business operations of the publishing house.

Response from Bessent

A spokesperson for the Trump transition team dismissed the claims as “meritless,” asserting that Bessent has paid his taxes and provided extensive records to demonstrate compliance with tax regulations. The spokesperson criticized the subjective interpretation of the tax code by Senator Wyden and his staff.

Expected Fallout

The memo is likely to prompt intense questioning from Finance Committee Democrats during Bessent’s nomination hearing. It presents an opportunity for Wyden to paint Bessent as disconnected from the Treasury Department and IRS priorities under President Joe Biden’s administration, which focus on combating tax evasion among the ultra-wealthy.

Outlook

Despite the controversy surrounding Bessent’s tax affairs, his support among Republicans remains strong, and his path to confirmation appears secure. Senate Finance Chair Mike Crapo (R-Idaho) has affirmed his intention to expedite the nomination process. Bessent’s compliance with the law and the rigorous vetting process have been emphasized by supporters.

Additional Concerns

Aside from the hedge fund and publishing house issues, the memo raises questions about a $500,000 deduction claimed by Bessent for “bad debt” in 2023. It also highlights potential circumvention of state and local tax deduction limits and calls for amendments to certain tax returns.

Conclusion

The allegations against Bessent have brought the spotlight on his tax practices, inviting scrutiny and debate. While Democrats push for further investigations and amendments to tax filings, Bessent’s nomination process is expected to proceed smoothly, underscoring the partisan divides in tax policy and enforcement.