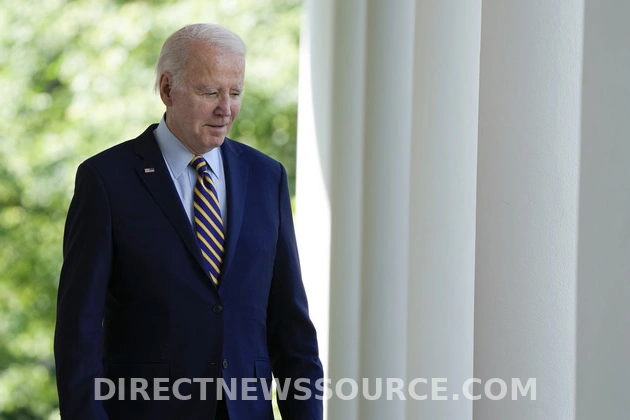

The Biden administration revealed on Friday the allocation of $4.28 billion in additional student loan relief for 54,900 individuals working in public service nationwide.

This relief contributes to a total of roughly $180 billion in loan forgiveness for almost 5 million Americans, as confirmed by the Education Department.

Education Secretary Miguel Cardona expressed, “Four years ago, the Biden-Harris Administration committed to rectifying the flawed Public Service Loan Forgiveness Program for America’s teachers, service members, nurses, first responders, and other public servants, and we have successfully fulfilled that promise.”

Certain Democrats in Congress have been urging the administration to forgive eligible borrowers before President Biden’s term concludes.

Senator Dick Durbin (D-Ill.), the second-ranking Democrat, asserted, “We must urge Joe Biden to act on this matter before departing for Delaware.” This statement particularly pertains to borrowers who fell victim to college fraud.

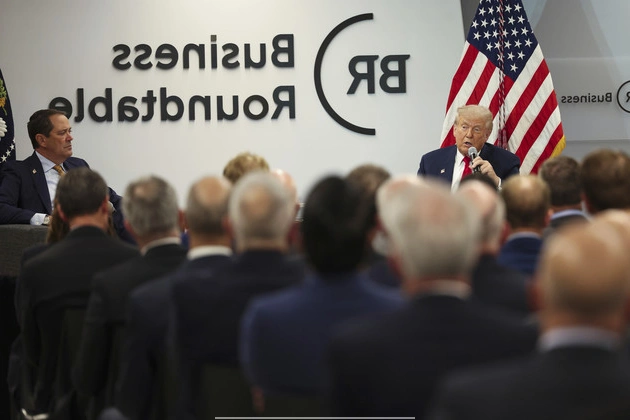

Concerns were raised regarding the potential contrast in debt relief approaches between the current and future administrations, with Senator Ed Markey (D-Mass) criticizing President Trump for his lack of substantial relief efforts for borrowers.

The Public Service Loan Forgiveness Program, originating from bipartisan legislation signed into law by President George W. Bush in 2007, aims to forgive loans for individuals engaged in specific public service roles such as teaching and nursing after a decade of payments.

Upon the program’s initial eligibility period in 2017, the U.S. Government Accountability Office reported a staggering 99 percent denial rate, often due to errors in past payment recognition or inaccurate qualification information provided to borrowers.

In 2019, the American Federation of Teachers filed a lawsuit against then-Education Secretary Betsy DeVos, accusing the agency of mishandling the program. The lawsuit was eventually settled in 2021 after alleging the arbitrary rejection of loan forgiveness applications and inadequate oversight of loan servicers by the Trump administration.

Stay informed with Weekly Education, your Monday briefing on the latest updates in education politics and policies.

Stay informed with Weekly Education, your Monday briefing on the latest updates in education politics and policies.

Subscribe to receive our newsletters and stay updated on education news. You can opt-out anytime by following the instructions in our Privacy Policy and Terms of Service. This website is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Loading

You will now start receiving email updates

You are already subscribed

Something went wrong

Subscribe to receive our newsletters and stay updated on education news. You can opt-out anytime by following the instructions in our Privacy Policy and Terms of Service. This website is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.