Solving the State and Local Tax Deduction Puzzle

Top Senate GOP tax writers are intensifying efforts to address the House’s stance on the state and local tax deduction, a key point of contention. Despite a recent meeting with President Donald Trump, consensus remains elusive on this politically sensitive matter.

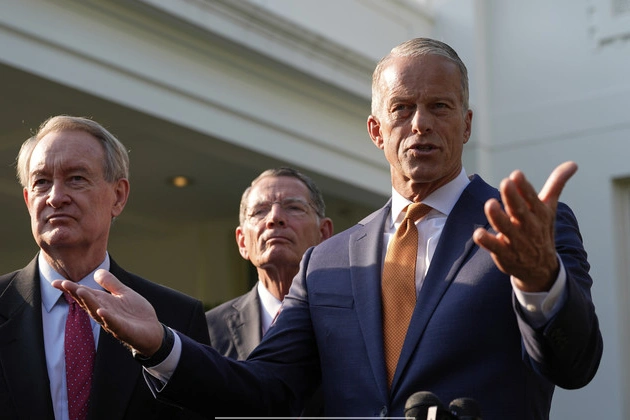

Senate Majority Leader John Thune emphasized that the SALT issue lacks resonance among Republican senators, signaling the need for significant revisions to garner Senate support.

Senate Finance Committee Chair Mike Crapo echoed this sentiment, highlighting the reluctance to allocate substantial funds to states that benefit at the expense of others.

Striking a Balance

While Senate Republicans recognize the need to accommodate the House’s concerns, they also face their own challenges. Any alteration to the hard-won SALT deal poses a potential hurdle in securing votes, particularly for Speaker Mike Johnson.

Senator Todd Young stressed the delicate balance required in enhancing the existing agreement while respecting the House’s dynamics.

During discussions with Trump, Senator Ron Johnson underscored the intricate math involved in securing support for the megabill, emphasizing the critical need for cohesive decision-making.

Charting the Course Ahead

Despite the complexity of tax reform deliberations, Senate Republicans are resolute in advancing their priorities. Ensuring permanent business tax cuts remains a key focus, with Thune reaffirming the commitment to chart a viable path forward.

Crapo echoed this sentiment, emphasizing the imperative of permanence in the forthcoming tax and spending legislation.

Staying the Course

The engagement with Trump underscored the urgency among Senate Republicans to meet the July 4 deadline for bill passage. Amid external pressures, including criticism from prominent figures like Elon Musk, senators remain steadfast in their pursuit of a comprehensive legislative solution.

Internal cohesion and alignment with Trump’s objectives are central to the GOP’s strategy as they navigate the intricate landscape of tax policy reform.