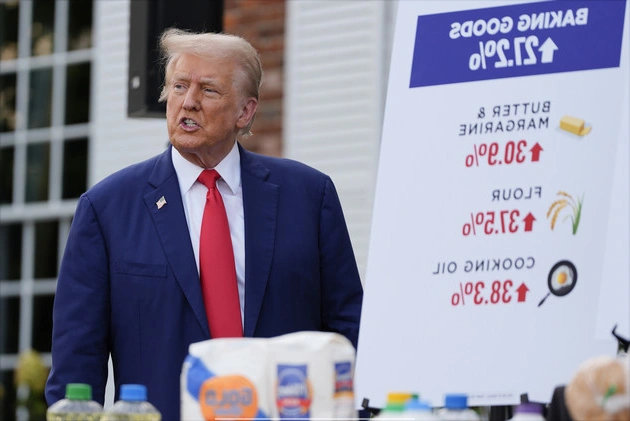

President Donald Trump’s trade policies have stirred concerns about inflation, but recent data suggests a different story. Prices have risen modestly, with core sectors showing a slight increase. Despite fears, Trump’s tariffs have not significantly affected the cost of living.

Positive Signs Amid Economic Uncertainty

The latest Consumer Price Index indicates a 2.3 percent annual increase in prices, the slowest since early 2021. Core sectors, excluding food and energy costs, have seen a 2.8 percent growth. These numbers provide a glimmer of hope amidst economic challenges.

Political Responses and Market Reactions

President Trump’s supporters view the data as a validation of his economic strategies. The administration’s optimism contrasts with public sentiment, as polls show waning approval for Trump’s economic agenda.

Analysts predict a potential rebound in inflation, despite current stability. The Federal Reserve remains cautious, monitoring import costs and consumer prices closely.

Contradictory Expectations vs. Reality

Forecasts anticipated rising prices due to tariffs on various imports. Surprisingly, sectors like clothing and automotive saw price decreases. While some electronics and goods experienced slight hikes, the overall impact was minimal.

Insights and Projections

Economists note a modest tariff pass-through in recent data, suggesting a limited effect on consumer costs. Consumer expectations of future price increases indicate ongoing economic uncertainty.

Central Banking Perspectives

New York Fed President emphasizes the importance of managing inflation expectations. Ensuring price stability is crucial, especially in times of heightened uncertainty.

Conclusion: Navigating Economic Trends

While Trump’s tariffs have not caused the expected price surges, the economy remains dynamic. Monitoring inflation trends and consumer responses will be key to navigating future challenges.