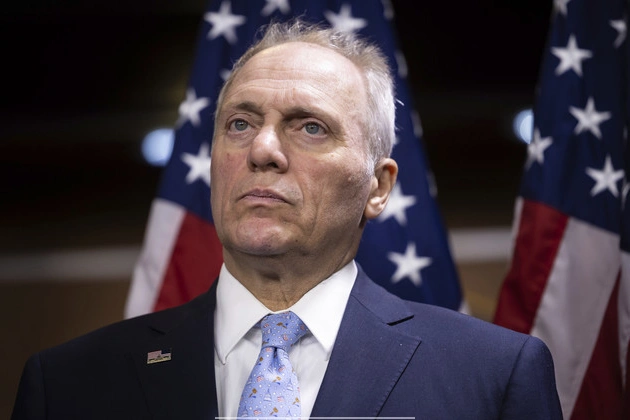

Prominent House Republicans are embroiled in a private feud over expiring tax cuts and President Donald Trump’s extensive list of tax requirements. Budget Chair Jodey Arrington and deficit hard-liner Rep. Chip Roy are at odds with Ways and Means Chair Jason Smith and other senior Republicans.

The Battle Over Tax Cuts

This dispute is impeding Speaker Mike Johnson’s efforts to push forward a budget blueprint. Various GOP factions continue to clash over the costs of the tax plan, strategies to offset them, and potential cost-saving adjustments to programs like Medicare and aid for low-income Americans.

Stumbling Blocks in Negotiations

Despite recent progress, negotiations on the GOP’s comprehensive policy bill face significant hurdles. Arrington, Roy, and other budget hawks are advocating for additional and contentious spending cuts. They are also advocating for modifications to the crucial ‘budget reconciliation instruction’ for the tax-writing Ways and Means Committee.

The reconciliation instruction establishes the maximum deficit increase allowed for the committee, considering a full extension of Trump’s 2017 tax cuts and the implementation of his other priorities.

Contentious Discussions

Smith presented a figure of around $5.5 trillion at the GOP’s retreat, reflecting the committee’s estimate of the cost to implement Trump’s priorities after considering spending cuts and revenue raisers.

Arrington, Roy, and other fiscal hawks aim to further restrict the committee’s deficit spending but diverge from Smith on the reconciliation instruction. Some senior Republicans are concerned about accommodating all of Trump’s tax demands within the package.

The tentative figure agreed upon last week, approximately $4.7 trillion, would make it nearly impossible to implement anything beyond an extension of the expiring tax cuts. House Republicans have committed to permanently extending the 2017 tax cuts, estimated to cost $4.6 trillion by Congress’ official accountants.

This $4.7 trillion number implies that concessions will be necessary. Republicans are exploring shorter timelines for some of Trump’s other tax priorities.

Adjusting the Policy Package

Arrington outlined two primary methods to adjust the cost of the GOP’s policy package: through tax adjustments and spending reductions. However, the effectiveness of these adjustments is limited.

While GOP leaders advocate for achieving all of Trump’s broad tax objectives, Roy warns that insufficient spending cuts could necessitate addressing shorter-term tax rates or selecting specific priorities.

Internal Strife and External Challenges

Internal discord among House GOP members is escalating, with concerns that certain factions may impede the passage of tax cut provisions. This could lead to significant tax increases or prompt bipartisan negotiations with Democrats before the year’s end.

The uncertainty surrounding budget negotiations underscores the challenges faced by House GOP leaders in advancing a unified legislative agenda that encompasses taxes, border policies, energy provisions, and national security measures.

While the House leans towards a comprehensive bill, the Senate prefers a two-track strategy, focusing separately on taxes and other policy areas.

Future Directions and Policy Implications

As discussions continue, the inclusion of Medicaid reforms, work requirements for social assistance programs, and the utilization of tariff revenue to fund the bill are being considered. The evolving landscape of budget negotiations underscores the complexity of balancing fiscal priorities and policy objectives.

Stay informed as developments unfold in the House GOP’s efforts to navigate the challenging terrain of tax cuts, Trump’s demands, and budget negotiations.