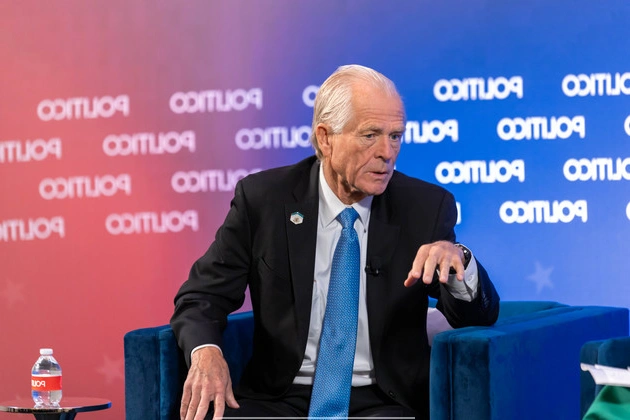

President Trump’s trade adviser, Peter Navarro, has been vocal in his support for the president’s ambitious plan to reshape the American economy through tariff revenue. In a recent interview at POLITICO Playbook’s First 100 Days breakfast series, Navarro emphasized the importance of reducing reliance on income taxes and increasing dependence on tariff income.

Navarro highlighted the potential for tariffs to replace income tax as the primary revenue source for the United States. Trump’s pledge to establish an ‘External Revenue Service’ dedicated to collecting tariff payments underscores his commitment to this economic overhaul.

Feasibility Study and Concerns

Trump’s executive order outlining the creation of the ‘External Revenue Service’ mandated a thorough examination of its feasibility by April 1. While the U.S. Customs and Border Protection currently handles tariff collections, the proposed shift has raised concerns among economists and lawmakers.

Economists caution that relying heavily on tariffs could lead to consumer price increases and inflation. Moreover, doubts linger about the feasibility of tariffs completely replacing the longstanding federal income tax system.

Republican Criticism

Even within Trump’s own party, skepticism exists regarding the reliance on tariffs for revenue generation. Rep. Adrian Smith, a prominent Republican on the Ways and Means trade subcommittee, expressed reservations about the potential consequences of such a strategy. He emphasized the risks associated with becoming overly dependent on tariff revenue, equating it to introducing another form of taxation.

As the debate continues, the implications of Trump’s tariff revenue plan on the American economy remain a topic of intense discussion among economists, lawmakers, and the public.