Optimizing Reconciliation Plans for Tax Legislation

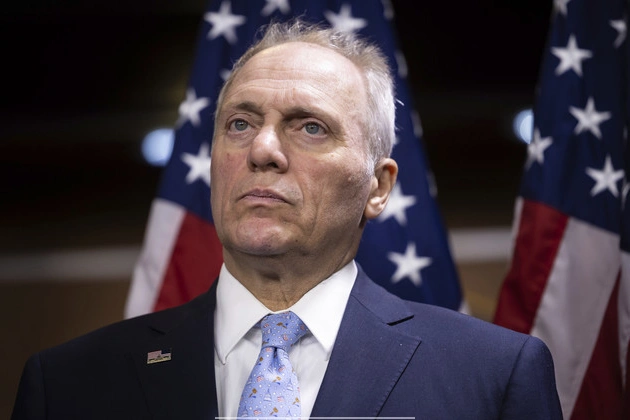

In the realm of tax legislation, the consolidation of the reconciliation package into a singular bill holds significant weight. Ways and Means Chair Jason Smith advocates for a unified approach, emphasizing the importance of avoiding a split in the legislation that could delay crucial tax cuts.

The Impact of Unity

For Smith, the stakes are high, as the fate of pivotal tax cuts hangs in the balance. Should Senate Republicans and the House Freedom Caucus push for division, the timeline for tax relief might be jeopardized, a scenario that contradicts Smith’s legislative priorities.

Decisive Factors in Reconciliation

Questions loom over the reconciliation process – who holds the authority to determine the inclusion and exclusion of provisions? How do elements like ‘no taxes on tips’ and the State and Local Tax (SALT) deduction factor in? And crucially, does Smith wield sufficient influence with President-elect Trump and Speaker Mike Johnson to ensure a consolidated, impactful outcome?

Insights from Jason Smith

Seeking clarity on these intricate matters, Playbook’s Eugene Daniels engaged in a thought-provoking dialogue with Smith. Their conversation delved into Smith’s vision for reconciliation, his critique of the Freedom Caucus’ strategy, and strategies for garnering support within the House to secure a favorable outcome.

Smith’s aspiration is clear – to present a unified bill that not only averts a substantial tax increase but also garners the necessary support for passage. His analogy of adding ‘candy’ to sweeten the deal underscores the strategic maneuvering required to secure the 218 votes essential for success.