After a lengthy period of deliberation, the fate of the U.S. Steel sale to Nippon Steel, a Japanese firm, now rests in the hands of President Joe Biden. This decision holds significant implications for foreign investment in the U.S. and sets the tone for future ventures.

The Committee on Foreign Investment in the United States (CFIUS), responsible for assessing such transactions for potential national security risks, has forwarded its report on the contentious deal to the White House and the involved companies. According to a reliable source, under the CFIUS statute, President Biden must render a final verdict on the sale within the next 15 days.

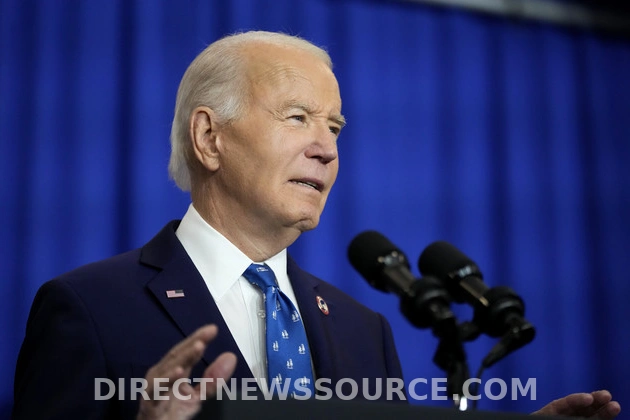

With CFIUS failing to reach a consensus on approving or rejecting the deal, the responsibility now falls on President Biden. The outgoing president, known for his support of organized labor, has expressed reservations about the sale, a sentiment echoed by the United Steelworkers union.

A senior White House official initially raised concerns about Nippon Steel’s proposed acquisition of the iconic American company a year ago, emphasizing the need for a thorough review of its potential impact on national security and supply chain reliability. Subsequently, Biden voiced strong opposition, emphasizing the importance of U.S. Steel remaining domestically owned and operated.

Despite speculations in the media that Biden was inclined to block the transaction, White House officials maintained that the president would await the CFIUS report before making a final decision.

The CFIUS report, released on the deadline day, outlines the transaction’s pros and cons and the proposed mitigation plan to address national security concerns. Nippon Steel remains hopeful for approval as it awaits Biden’s decision.

On the contrary, the United Steelworkers, representing over 20,000 U.S. Steel employees, continue to oppose the deal, citing concerns about job security and the national steel industry’s future.

Nippon Steel, in a statement, highlighted its commitments to U.S. Steel’s growth, American job protection, and the overall steel industry’s enhancement, urging a fair evaluation of the transaction based on its merits.

Amidst the uncertainty, Nippon has pledged significant investments to upgrade U.S. Steel facilities, underlining the potential impact of the proposed deal on the U.S. economy and reputation as an attractive investment hub.

Experts and industry observers have criticized both Biden’s and CFIUS’s handling of the transaction, raising concerns about the process’s transparency and adherence to national security protocols.

The escalating tensions between the involved parties indicate a complex legal battle ahead, with Nippon hinting at potential litigation if the deal faces obstruction. However, any legal victory may not alter the outcome due to the president’s authority in national security matters.

As the saga unfolds, the fate of the U.S. Steel sale hinges on various factors, including political dynamics and the union’s stance. The outcome will not only impact the parties involved but also shape the future of foreign investments in the U.S.